The Tesco (LSE:TSCO) share price experienced strong growth in the second half of 2023, but it’s made a weak start to the new year. JPMorgan Cazenove recently slashed its price target for Britain’s largest grocery stock to 220p. That’s well below today’s price of 282p per share.

So are Tesco shares showing signs of exhaustion? Or can investors expect this FTSE 100 stock to deliver good returns in 2024?

Here’s what the charts say.

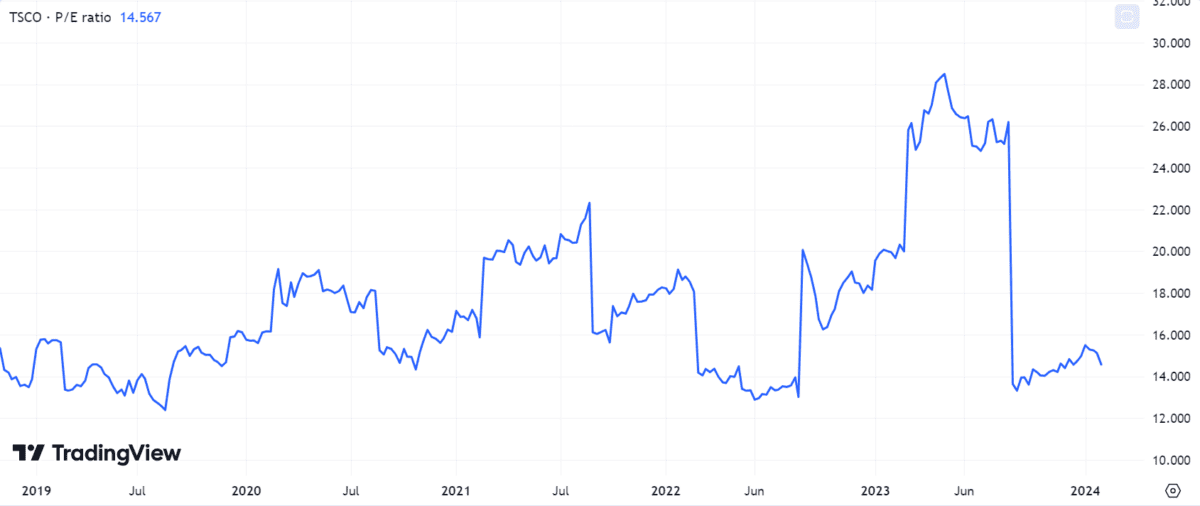

Valuation

At first glance, Tesco’s price-to-earnings (P/E) ratio above 14.5 might not seem especially cheap relative to the wider FTSE 100 index. However, this multiple is towards the bottom end of where the stock has traded over the past five years.

In addition, the forward P/E ratio is a little lower, at around 12.3. I wouldn’t say that’s bargain basement territory, but equally the shares don’t look particularly expensive either.

The grocery giant expanded its market share over the crucial Christmas period. Moreover, the board upgraded this year’s adjusted operating profit guidance for Tesco’s retail business from a range of £2.6bn-£2.7bn to £2.75bn.

In that context, the valuation doesn’t give me too much cause for concern at present.

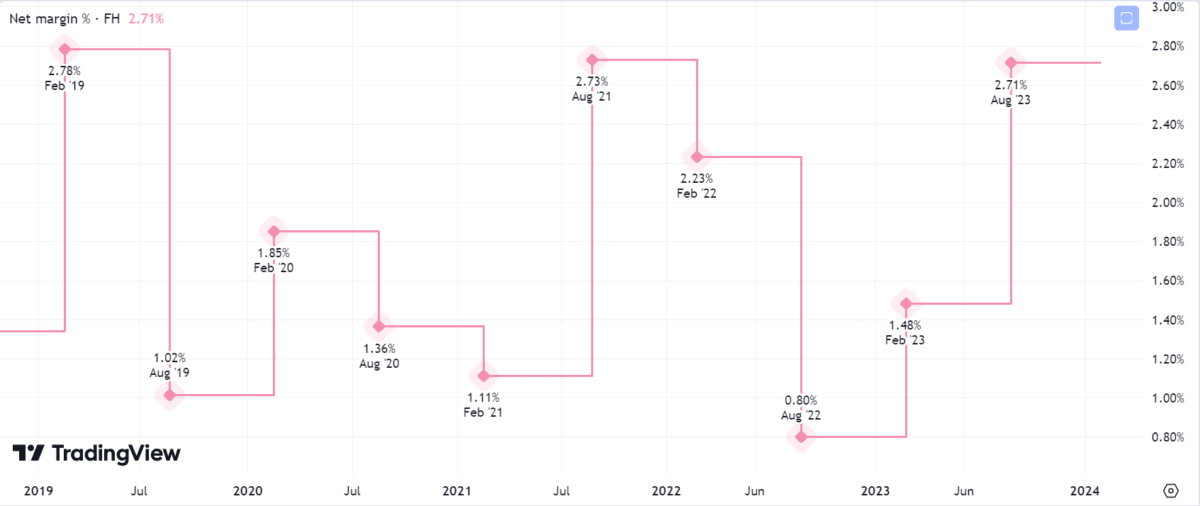

Margins

However, I do see margins as a bigger worry for the future direction of the Tesco share price.

On the bright side, Tesco’s net margin has held up well despite recent cost inflation. That said, looking back over the past five years it’s been a bit of a rollercoaster ride, which reflects the intense competition in the sector.

Strong sales have been helped by price cuts on almost 2,700 products in an effort to stave off value rivals like Aldi and Lidl. Whether the business can sustain this strategy while preserving healthy margins remains to be seen. It won’t be an easy task.

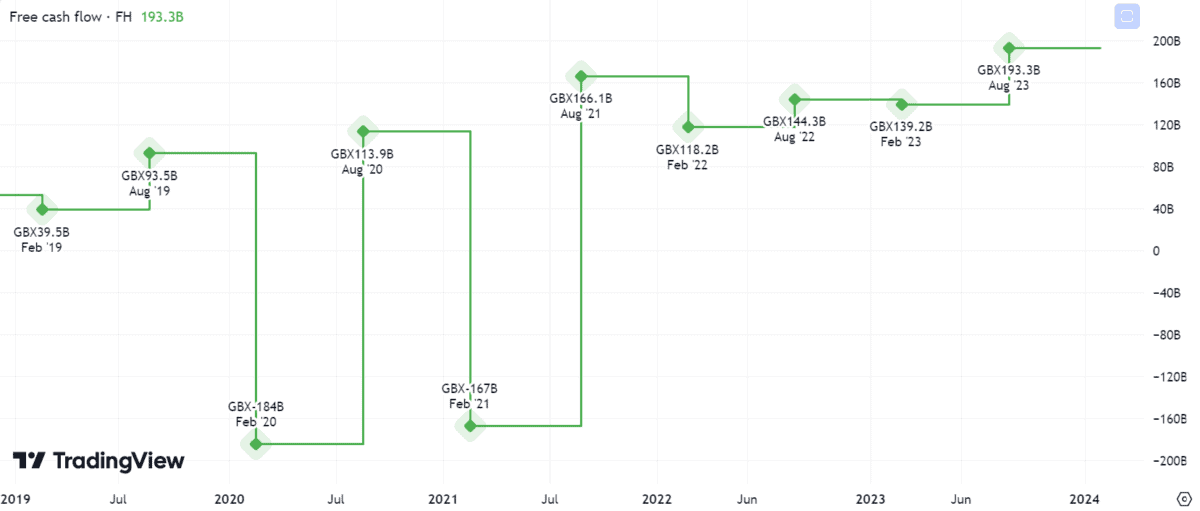

Free cash flow

Nonetheless, there’s much to cheer on the free cash flow front. Steady improvement on this metric over the past couple of years has been particularly encouraging.

Robust free cash flow is essential in supporting dividend distributions. With a healthy forward yield of 4.1% and robust forecast cover of 2.1 times earnings, Tesco shares look well-placed to continue providing a steady flow of passive income.

Of course, no dividends are guaranteed. After all, the supermarket didn’t pay any in 2016 and 2017 amid the fallout from a damaging accounting scandal.

Where next for the share price?

There are some medium- and long-term risks for the future of the Tesco share price, especially in the form of rising competition.

However, the company has fended off these challenges well so far and recent results show plenty of promise. As such, I think it’s too early to call time on the Tesco share price rally and the stock could climb further in 2024.

Any sign of margin compression would be a red flag and one investors should monitor carefully. Nonetheless, provided the company continues to exhibit strength in its financials, I’m happy to continue holding my position.

Overall, I believe this is a stock that investors should consider for 2024.